PPP Loan Fraud Investigations & Forgiveness Updates

Did the Paycheck Protection Program, designed as a lifeline for struggling businesses during the pandemic, become a breeding ground for fraud? The unsettling truth is that while the PPP offered crucial relief, it also attracted opportunistic individuals who exploited the system for personal gain. The whispers of a "PPP warrant list" circulating on social media highlight the public's fascination with these alleged schemes and the pursuit of justice.

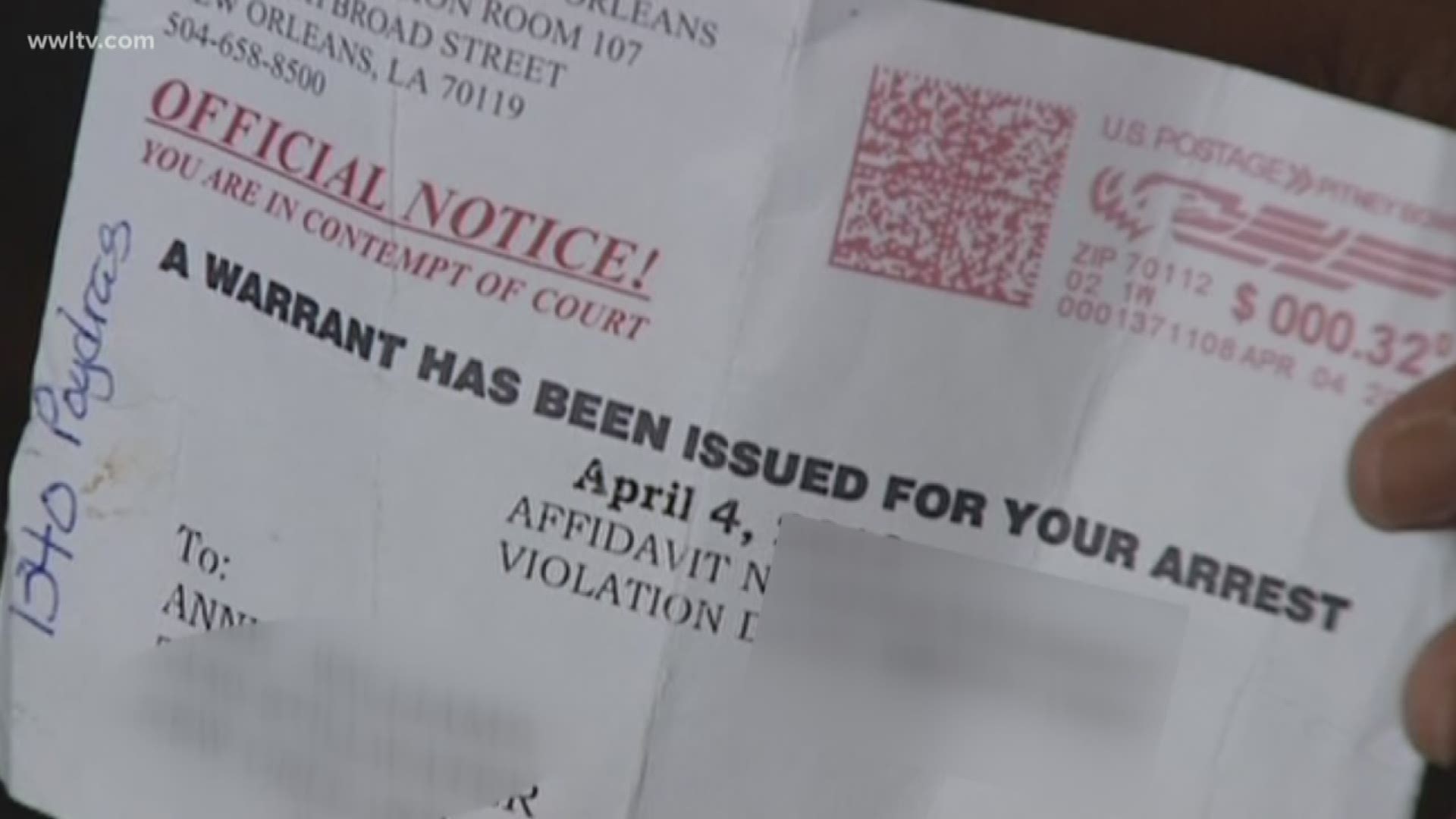

The sheer scale of the program the Small Business Administration approved 11.47 million loans totaling $792.6 billion as of July 4, 2022 created ample opportunity for both legitimate aid and fraudulent activity. Federal agencies are actively investigating numerous companies and individuals suspected of PPP loan fraud. These investigations encompass a range of violations, from outright fabrication of applications to technical breaches of the program's rules, such as failing to document the economic necessity for the loan. While social media buzzes with talk of "PPP arrest warrants" and readily accessible lists of offenders, the reality is more nuanced. There is no publicly available "PPP warrant list." These rumors often conflate legitimate investigations with misinformation, creating unnecessary anxiety for borrowers who adhered to the program's guidelines.

| Name | [Name Redacted - No specific individual is the focus of the original content] |

|---|---|

| Date of Birth | [Date Redacted] |

| Career | [Career Redacted] |

| Professional Information | [Professional Information Redacted - This table serves as a placeholder to demonstrate the format. Real-world application would necessitate focusing on specific individuals identified in investigations.] |

| Reference | U.S. Small Business Administration - Paycheck Protection Program |

The intent of the PPP was to incentivize small businesses to retain their employees during the economic turmoil of the pandemic. However, the programs rapid rollout and streamlined application process, designed to quickly distribute funds, inadvertently created vulnerabilities. Multiple federal agencies are now working diligently to unravel complex schemes involving fraudulent PPP loan applications. These investigations often involve detailed analysis of financial records, communication logs, and other documentation to determine whether borrowers misrepresented their eligibility or misused the funds.

The Justice Department has pursued several high-profile cases related to PPP fraud. These cases highlight the diverse tactics employed by fraudsters, from creating fictitious businesses to inflating payroll figures to diverting funds for personal expenses. Sentences for those convicted of PPP fraud can range up to 20 years in prison, depending on the severity of the offense. For example, on February 13, 2024, five individuals were indicted in federal court in Brooklyn on charges related to a treasury check washing conspiracy, with three also facing charges of defrauding the PPP.

Another case involves allegations against individuals who conspired to submit fraudulent PPP and EIDL applications. In one instance, a defendant allegedly received approximately $3.3 million in PPP loan funds and $450,000 in EIDL funds based on fraudulent applications submitted between April 2020 and April 2021.

The government's pursuit of PPP fraud extends beyond criminal charges. The SBA also has the authority to pursue civil penalties and seek repayment of fraudulently obtained funds. The agency works in conjunction with other federal agencies, such as the FBI and the IRS, to investigate and prosecute PPP fraud cases.

While the PPP officially ended on May 31, 2021, its legacy, including the ongoing investigations and prosecutions for fraud, continues. Existing borrowers may still be eligible for loan forgiveness, but they must adhere to the program's stringent documentation requirements to avoid scrutiny. The SBA provides resources and guidance to assist borrowers with the forgiveness process. Those seeking information about specific PPP loans can access databases maintained by the SBA, which allow searching by organization, lender, zip code, and business type.

The PPP experience underscores the challenges of balancing the urgent need to provide rapid financial relief during a crisis with the crucial importance of safeguarding against fraud and abuse. The ongoing investigations and prosecutions serve as a stark reminder of the consequences of exploiting programs designed to support those in need.

Unveiling The PPP Warrant List A Comprehensive Guide To Loan

Unveiling The Power Of PPP Loan Warrant List A Comprehensive Guide For

Unveiling The PPP Warrant List A Comprehensive Guide To Loan